Author: David I. Templeton, CFA, Principal and Portfolio Manager

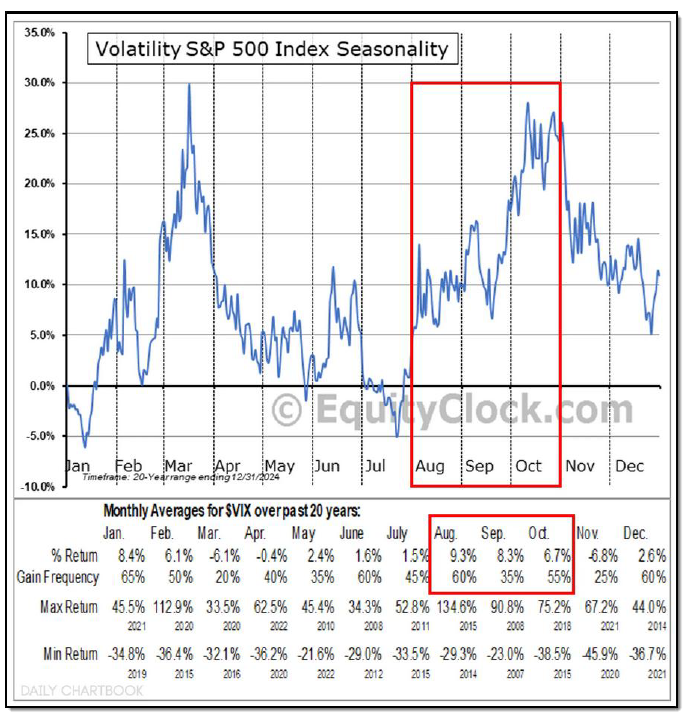

August has a reputation for heightened equity market volatility, and this year is no exception. The month kicked off with a sharp selloff following Friday’s disappointing nonfarm payroll report, which triggered a -1.6% decline in the S&P 500 Index. That drop capped a week of fractional losses from Tuesday through Thursday, bringing the total weekly decline to -2.37%. This reversal followed a six-day winning streak through Monday, underscoring the market’s sensitivity to economic data.

Payroll Report Miss and Historic Revisions

The July nonfarm payroll report (PDF) of +73,000 employment and missed expectations by 42,000. However, but what seemed to rattle the investors were the substantial downward revisions to prior months. As noted by Goldman Sachs,

"The net downward revision of 258,000 to May and June payroll growth was the largest two-month revision since 1968 outside of NBER-defined recessions (assuming the economy is not in recession now). The revision was roughly evenly split between public- and private-sector jobs. The revision to public-sector payroll growth mostly reflected lower state and local government job gains (-109k), reversing an initially estimated spike that itself likely reflected estimation challenges around the end of the school year. The revision to private-sector job gains was concentrated in the underlying response data, which we see as more meaningful than a revision to the seasonal factors."

Chamath Palihapitiya, CEO at Social Capital, highlighted the broader issue: since January 2020, the Bureau of Labor Statistics (BLS) has revised its initial payroll data 134 times across 67 monthly reports, averaging two revisions per report. Given the market’s reliance on this data, improving the accuracy and methodology of initial estimates would be a welcome development.

Unemployment Rate Signals Caution

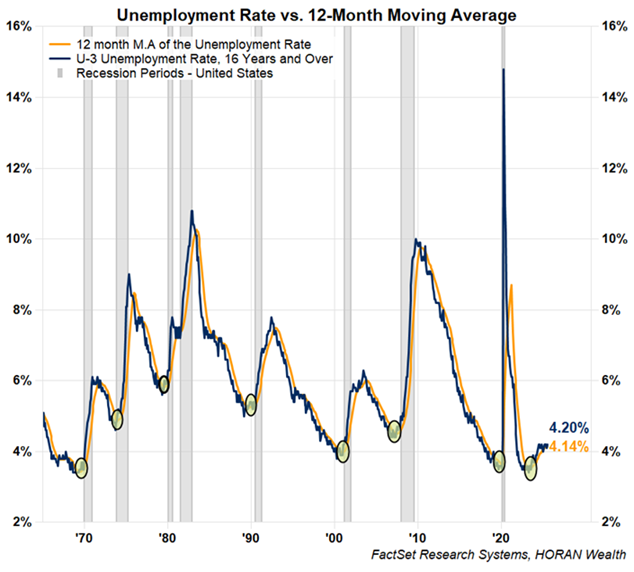

As shown in the chart below, the July unemployment rate of 4.20% remains above its 12-month moving average. Historically, such crossovers, marked by yellow circles, often precede recessionary periods, as indicated by the grey shaded bars.

GDP Growth: Solid but Uneven

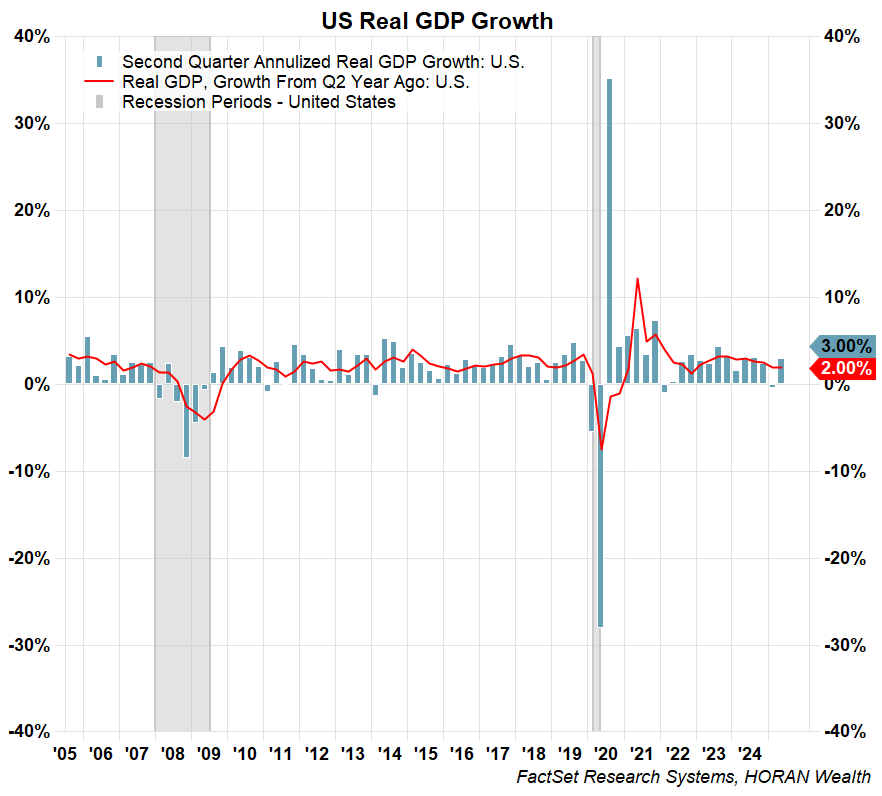

Wednesday’s GDP report showed real economic growth of 3% annualized in Q2 2025, up from 2% year-over-year. The improvement was driven by a decline in imports, which had weighed on Q1 GDP due to front-loaded inventory purchases ahead of anticipated tariff hikes. While Q2 growth was positive, the underlying momentum remains mixed.

Rate Cut Expectations Rise

The Federal Reserve held rates steady last Wednesday, and Chair Powell’s comments initially pushed the odds of a September rate cut below 50%. However, following Friday’s weak payroll data and tepid GDP growth, market expectations for a 25 basis point cut in September have surged to nearly 90%.

Corporate Earnings Show Resilience

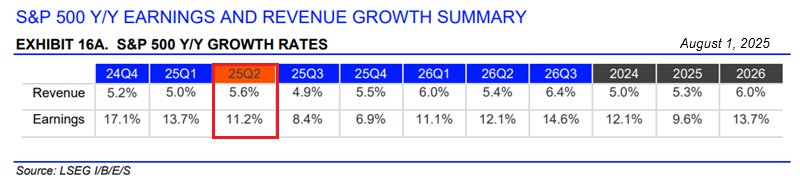

Despite of some soft economic data, corporate earnings remain a bright spot. LSEG is reporting earnings for Q2 2025 are expected to increase 11.2% on a year over year basis. Of the 330 companies reporting to date, LSEG shows 80.6% have reported earnings above analyst expectations. This compares to the long-term average of 67.1%.

Looking Ahead: Volatility and Opportunity

With August historically prone to volatility and the market's strong advance from the April low, a period of consolidation could be healthy. As the chart below illustrates, the VIX tends to spike in August, suggesting elevated risk, but also potential opportunity. If macro conditions stabilize and earnings continue to surprise to the upside, the latter half of the year could still deliver favorable returns.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.