Author: David I. Templeton, CFA, Principal and Portfolio Manager

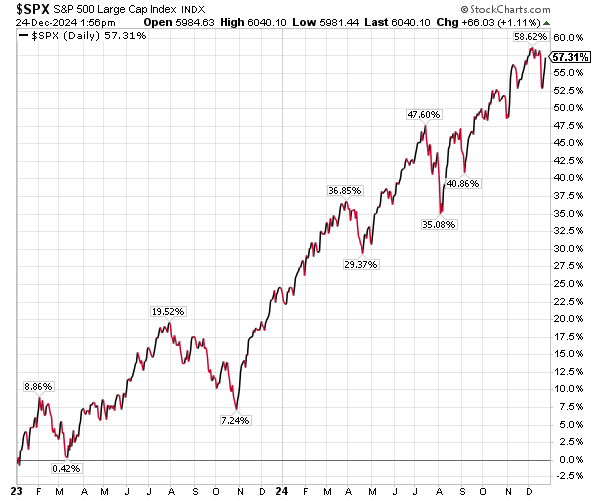

With the year 2024 approaching an end, most equity investors can cheer the strong year that has followed 2023. Over the course of the last two years, equity investors in the S&P 500 stocks have enjoyed a cumulative price only return of 57.3% as seen in the below chart.

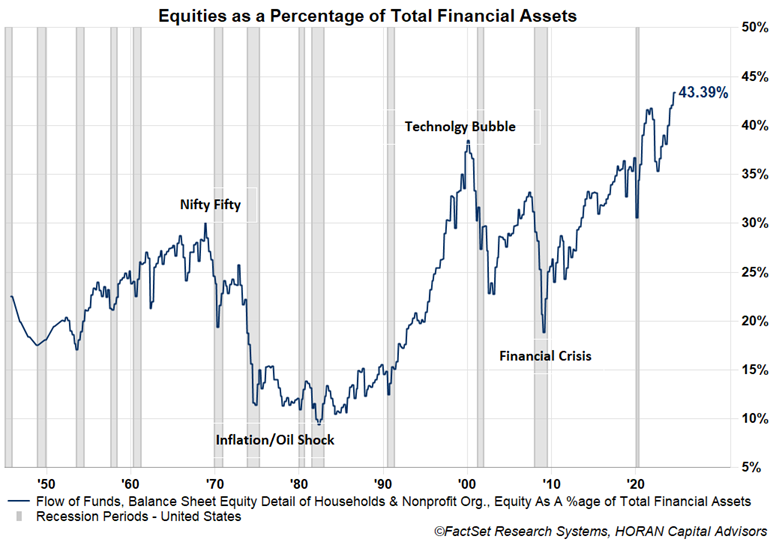

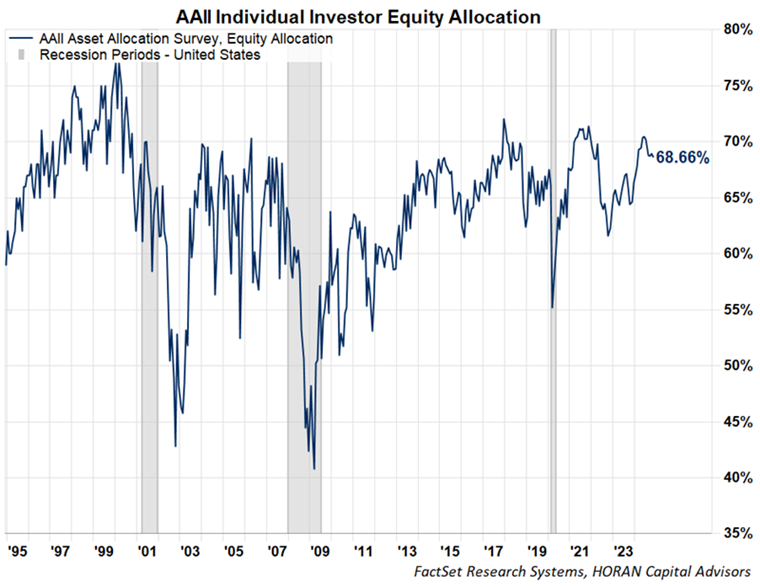

With the strength of the equity market, investor allocations have moved higher as well. As seen in the chart below, containing data from the Federal Reserve's Flow of Funds report, household equity allocations are at a record high of 43.4%. The chart that follows the Flow of Funds one details the American Associations of Individual Investors (AAII) equity allocation from the AAII's monthly survey. Both charts are representative of investors that appear to have an elevated exposure to stocks.

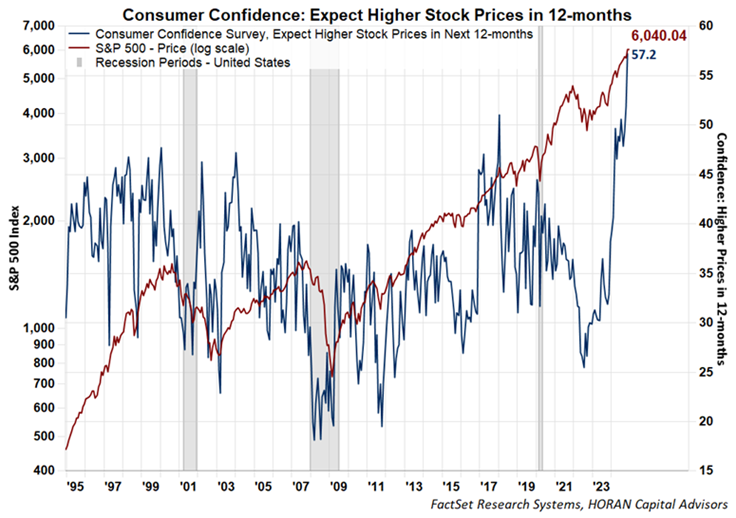

Lastly, sentiment measures are contrarian ones, and the recent Conference Board survey of consumers show individuals are bullish on stocks. A record 57.2% of consumers expect stock prices to be higher in 12-months. Of course, a pull back in the interim would not be a surprise, yet individual investors are bullish on stocks over the course of the next year.

In conclusion, investor actions would seem to confirm their favorable view on stock performance in the coming year given their stated equity allocations. On the other hand, the heightened favorable view by individuals on the stock surveys have historically occurred near equity market tops, even if just interim tops.

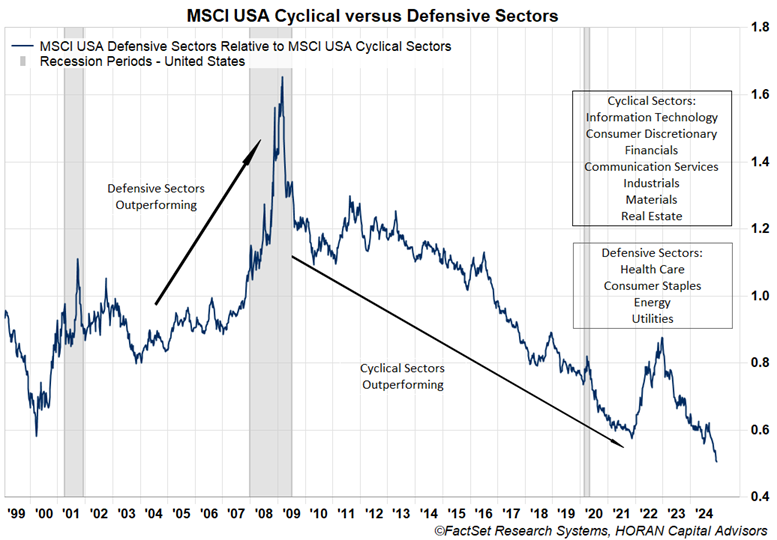

A large portion of the equity returns this year have been concentrated in the Magnificent Seven (MAGS) stocks. A port in a potential storm may be found in some of the value-oriented equities that have significantly lagged the performance of the MAGS. The line on the below chart of cyclical versus defensive indexes resembles the value versus growth line chart.

The cyclically oriented sectors include a number of stocks that contain technology-oriented stocks within the Information Technology, Consumer Discretionary and Communication Services sectors. The defensive sectors contain more of the value-oriented equities and investors may find stocks in these sectors that hold up better in a market pullback.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.