Author: David Templeton, CFA, Principal and Portfolio Manager

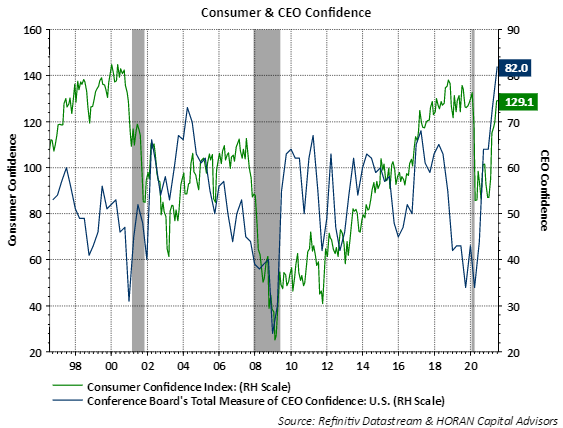

The Conference Board's Tuesday report on consumer confidence suggests economic activity in this third quarter remains robust. The July consumer confidence index ticked slightly higher to 129.1 versus June's reading of 128.9. Lynn Franco, Senior Director of Economic Indicators at The Conference Board, noted in the report, "Consumers’ optimism about the short-term outlook didn’t waver, and they continued to expect that business conditions, jobs, and personal financial prospects will improve...Spending intentions picked up in July, with a larger percentage of consumers saying they planned to purchase homes, automobiles, and major appliances in the coming months..."

Also included on the above chart is the Conference Board's latest CEO Confidence Measure which will be updated early next month. This data point is far above the level seen going into the pandemic last year.

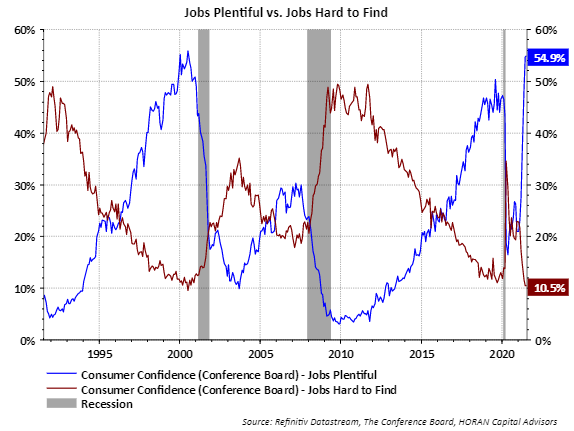

The Conference Board's broader survey includes consumer responses to other categories. The below chart provides insight into consumers' attitudes towards the job market. Clearly, consumers believe the job market is strong as 54.9% responded that jobs were plentiful and only 10.5% responded with jobs hard to find. The consumers' viewpoint on jobs is similar to the business side. In the ISM Manufacturing PMI report earlier this month, respondents noted lack of labor as an issue in getting orders filled.

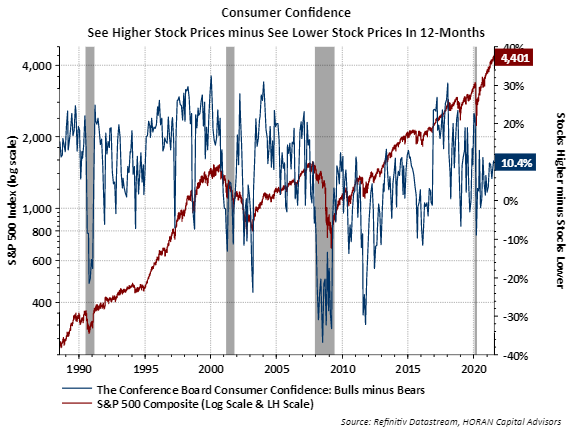

And lastly, given the high level of consumer confidence, another category surveyed is consumer views on the stock market. The stock market sentiment measures are contrarian ones and are most actionable at their extremes. The below chart shows the difference between consumers' responses to whether they expect stocks prices to be higher or lower in 12-months.A high percentage would be a negative data point as it would show extreme stock market optimism by individual consumers. The 10.4% reading is only slightly above the 8% average for this data point so neither extreme optimism or extreme pessimism.

In conclusion, consumer confidence remains at a high level and this is a positive indicator of a potentially stronger economic environment in the second half of this year.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.