Author: David I. Templeton, CFA, Principal and Portfolio Manager

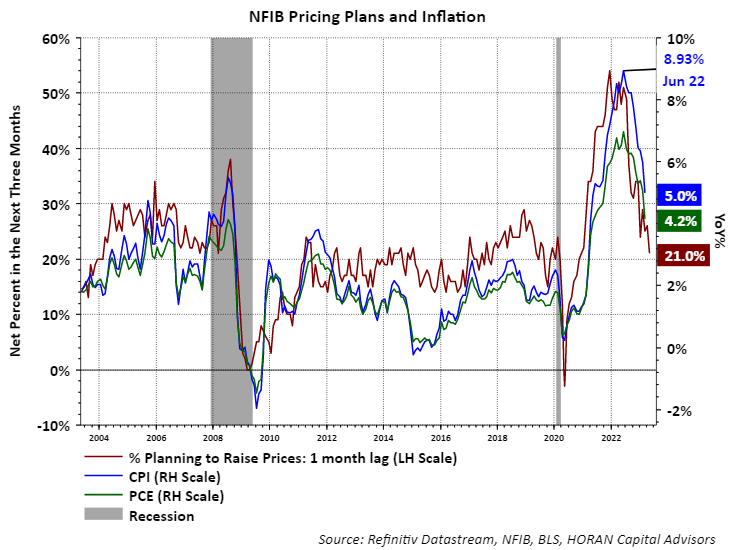

As NFL teams rotated into their position to make a draft selection in the recently completed NFL draft, they were placed "on the clock" in terms of having a limited time to make their pick known. Wednesday morning the much-awaited consumer price index report is released by the Bureau of Labor Statistics and as the clock ticks down to the 8:30 release, market expectations are the year over year inflation rate will come in at 5%. This rate is essentially the same rate as reported in March's report. We noted in our Spring Investor Letter inflation in the back half of this year is likely to remain elevated on a year over year basis due to the lower monthly rates at the end of last year. A low monthly inflation rate was also reported in April 2022, i.e., .39%, down from 1.01% in March. This lower rate in April last year is contributing to the elevated rate expected in Wednesday's CPI report. Still, inflation has trended back towards the Fed's 2% target rate from the near 9% YoY rate in June 2022 as seen below. In other words, the trend in inflation is moving in the right direction.

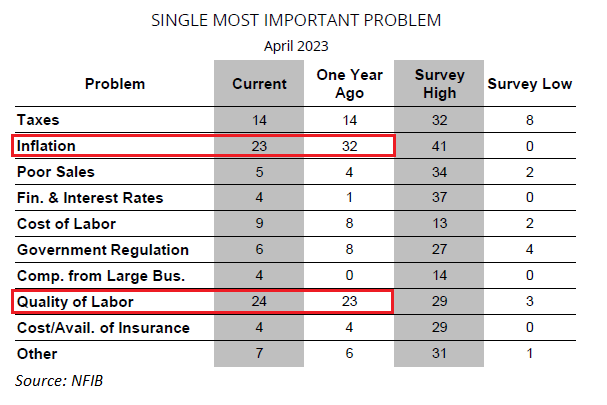

When inflation is running at a high level, companies look to raise prices to offset higher input costs. Today, Tuesday, the NFIB Small Business Optimism Index was released and the index declined to 89.0 and remains below the long-term average of 98. Included in the index is a survey of small businesses on various issues impacting their business, inflation being one of them. In the report, businesses cited inflation as one of their two top concerns, with quality of labor the single most important issue. However, as the maroon line on the above chart shows, lagged by one month, a smaller percentage of small businesses are planning to raise prices. The level of inflation as denoted by the blue line has a high correlation to business' plans on price increases, and with the plan to increase prices declining, inflation may follow as it has in the past.

Market expectations around the Federal Reserve's next move on inflation is a pause at the June and July meetings. An important variable the Fed will incorporate into their next rate decision is the level of inflation, and more importantly the trend in inflation. Tomorrows CPI release should shed more light on this data point.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.