Author: David Templeton, CFA, Principal and Portfolio Manager

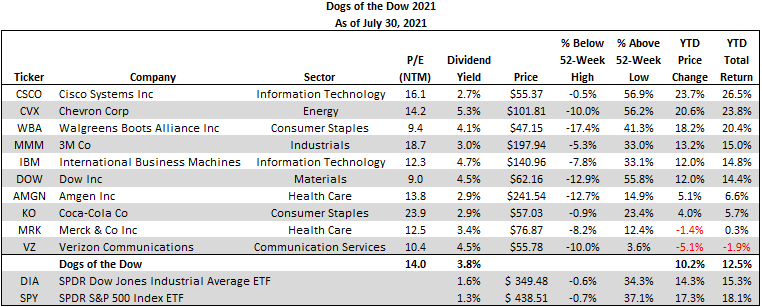

I last reported on the performance of the 2021 Dogs of the Dow at the end of the first quarter. At that time the Dow Dogs performance was 300 basis points ahead of the performance of the Dow Jones Industrial Average Index and 450 basis points ahead of the S&P 500 Index. With the market's close this past Friday, July has come to an end and it has been four months since that last article. Through the first seven months of this year, the Dow Dogs are up 12.5% and now trail the SPDR Dow Jones Industrial Average ETF (DIA) by about 200 basis points and trail the SPDR S&P 500 Index ETF (SPY) by 560 basis points.

The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. The popularity of the strategy is its singular focus on dividend yield.

One of the risks with this strategy is its concentration in just ten stocks. A part of the reason for the strategy's underperformance since the end of Q1 is tied to the underperformance of Walgreens Boots Alliance (WBA), down 12.7% since the first quarter, no allocation to Microsoft (MSFT), which is up 17.8% in the last four months and no holdings in the financial and discretionary sectors. Relative to the S&P 500 Index, the Dow Dogs underperformance is related to similar factors, although the position weightings in the S&P 500 Index are different than the Dow Jones Industrial weightings.

Over the long run the Dow Dog strategy has outperformed the DJIA and S&P 500 Indexes. Underperformance in some of the more recent years can be attributed to underweights in some of the FANGMA stocks a well as holdings in some of the energy positions that comprise the DJIA. There have been years where the strategy has lagged significantly, not the case year-to-date, so the Dow Dogs remain in the performance derby with five months left in 2021.

Disclosure: Firm and/or family long: CSCO, MMM, DOW, MRK, VZ

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.