Author: David I. Templeton, CFA, Principal and Portfolio Manager

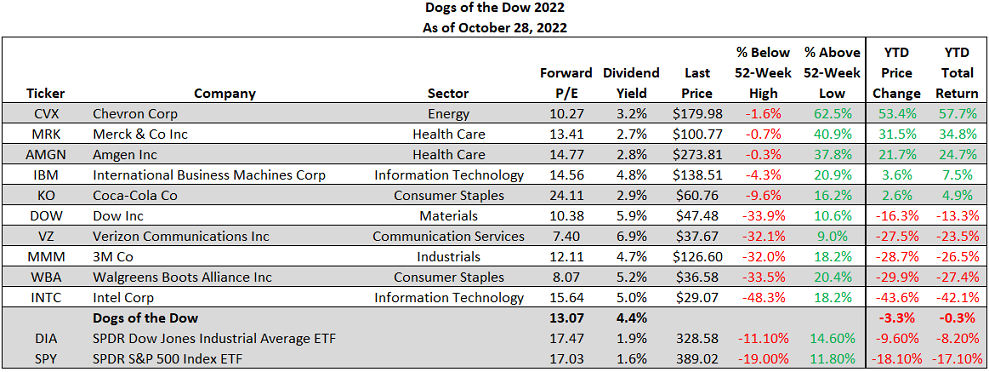

From time to time I include an update on the performance of the Dogs of the Dow investment strategy. The last update was more than six months ago, April 16 to be exact. At that time the Dow Dogs strategy had a positive year-to-date return versus the negative return of the Dow Jones Industrial Average Index and the S&P 500 Index. In fact, the Dow Dogs' return was better by some 1,000 basis points. Now, with two months left in the year, the 2022 Dogs of the Dow continue to maintain an impressive performance advantage over the Dow Jones and S&P 500 indices. As the below table shows, the year-to-date total return as of October 28, 2022 of the 2022 Dogs of the Dow equals -.3% compared to -8.2% for the Dow Jones Industrial Average Index and -17.1% for the S&P 500 Index.

As noted in earlier posts, the Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. At this point in time, if the year ended today, there would be three changes to the Dogs of the Dow for 2023.

- The three stocks that would be included are Cisco (CSCO), JP Morgan Chase (JPM) and Goldman Sachs (GS)

- The three stocks that drop out would be Coca-Cola (KO), Amgen (AMGN) and Merck (MRK)

Of course, the year has yet to come to an end, so an update will be provided at that time.

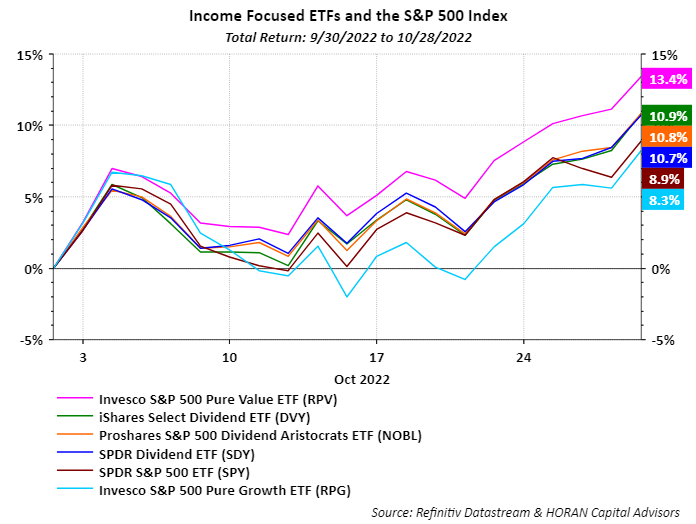

As the below chart shows, the S&P 500 Index (maroon line) has had a strong return recovery in October, up 8.9% for the month. Even with this apparent risk on recovery in equities, the value and dividend style equities continue to outperform the broader market.

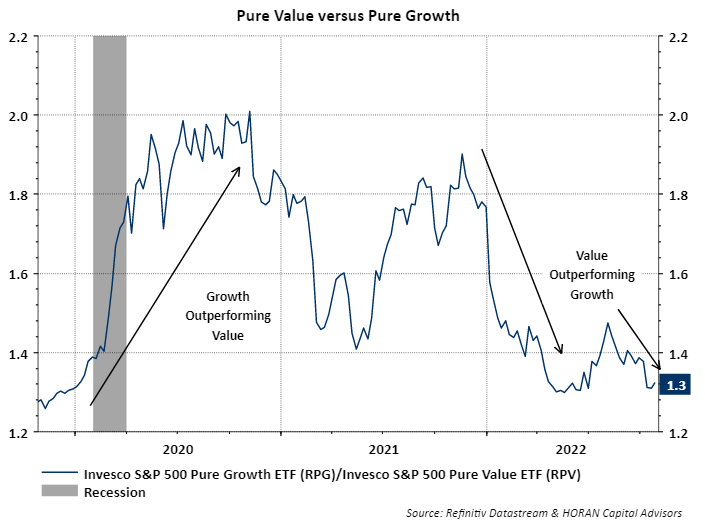

And, looking at value versus growth, the Pure Value style has mostly been favored this year except for growth's outperformance from the June low to early August. Given some recent earnings weakness seen in some of the growth oriented technology stocks like Meta Platforms (META), value/dividend paying stocks might experience a longer-term favorable performance period as the year comes to a close in a few months.

Disclosure: Firm/Family long DOW, MRK, VZ, INTC, MMM, JPM, CSCO

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.