Author: David I. Templeton, CFA, Principal and Portfolio Manager

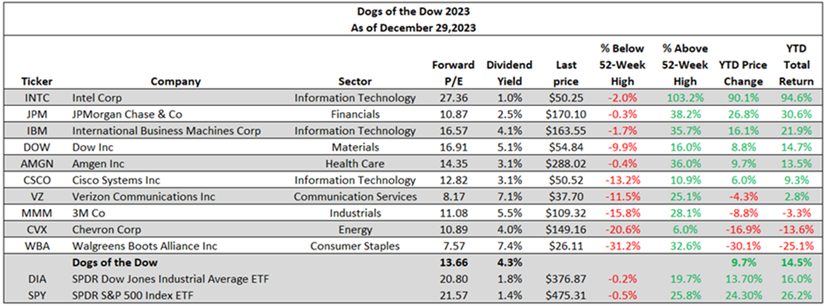

With all the hype surrounding the Magnificent Seven stocks and their outperformance this year, it is not surprising the Dogs of the Dow strategy also underperformed the broader market in 2023. The 2023 Dogs of the Dow contained none of the so-called Mag 7 stocks (Meta Platforms, Amazon, Apple, Microsoft, NVIDIA, Tesla and Alphabet); hence, making it difficult to keep pace with the market, i.e., both the S&P 500 Index and the Dow Jones Industrial Average index. In the fourth quarter though, the Dow Dogs generated mid-teens growth that resulted in the 2023 total return equaling 14.5% for the year and almost matching the Dow's return of 16.0%. At the end of the third quarter, the Dow Dog strategy total return was .4%.

The Dogs of the Dow strategy has the sole focus of investing in the highest dividend yielding stocks in the Dow Jones Industrial Average Index. The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. With 2023 now behind us, two new Dogs of the Dow are being added for 2024, Coca-Cola (KO), yielding 3.1% and Johnson & Johnson (JNJ), yielding 3.0%. To make room for these two additions, Intel (INTC) with a dividend yield of 1.0% and JP Morgan Chase & Co. (JPM) with a dividend yield of 2.5% are dropping off of the Dow Dogs list in the coming year.

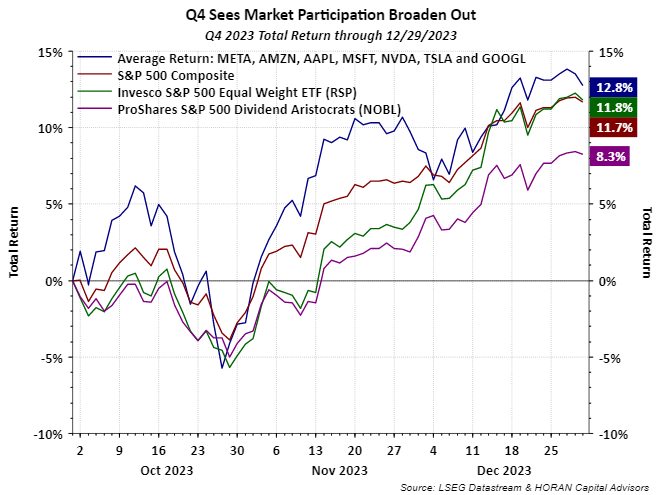

More detail is to follow in our firm's end of year newsletter, however, a broadening in market participation started to occur in the second half of 2023, especially in the fourth quarter. This was not only evident in the better performance of the dividend yield focused Dow Dog strategy, but also in the outperformance of the Invesco S&P 500 Equal Weight ETF (RSP.) As the below chart shows, in Q4 the equal weight S&P 500 Index returned 11.8%, outperforming the capitalization weighted S&P 500 Index return of 11.7%. Not significant outperformance, but some evidence of more stocks participating in the market's advance. This could be a positive sign for further equity gains as 2024 unfolds.

Disclosure: Firm/family long INTC, JPM, DOW, AMGN, CSCO, VZ, MMM, JNJ

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.