Author: David I. Templeton, CFA, Principal and Portfolio Manager

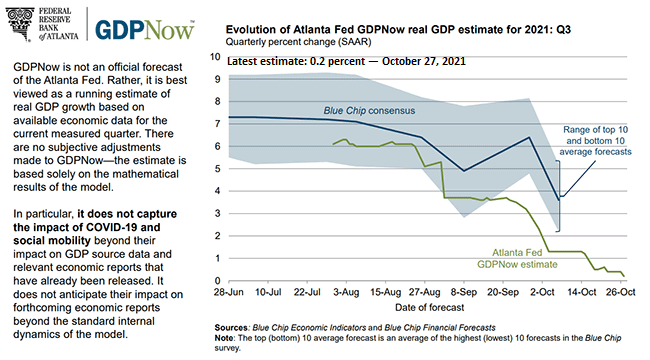

Thursday morning, October 28, 2021, the Bureau of Economic Analysis will report the Advanced reading on third quarter GDP or economic growth. At the beginning of Q3, 2021 GDP estimates were running between 5.5% to 9%. This range has narrowed to roughly .7% to 5% with the consensus estimate equaling 2.7%. The Atlanta Fed publishes an unofficial running forecast of GDP called GDPNow that incorporates the most recently available economic data. The last reading today has the GDPNow forecast for GDP at a meager .2%.

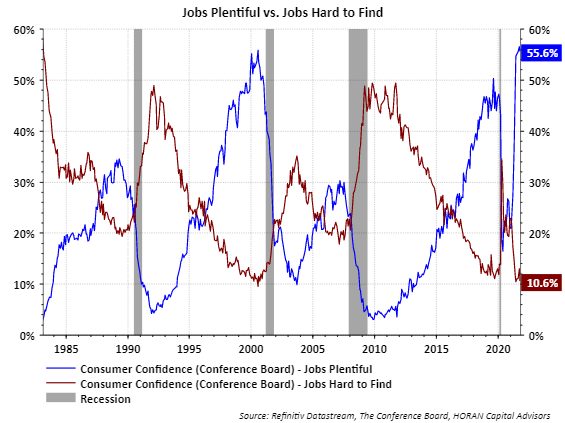

There has been mixed data on the economy of late due to the pandemic shutdown and subsequent reopening along with the resultant clogged supply chain. The supply chain issue is evident by the backup in ships attempting to get into two California ports to off load products. Nonetheless, some of the data being reported, like GDP, is at levels typically seen prior to the economy nearing a recession. An example is the "jobs plentiful' versus "jobs hard to find" data reported by The Conference Board (TCB) earlier this week. As the below chart shows, a near record 55% say 'jobs are plentiful' and near record low say 'jobs are hard to get.' Again these data points are at levels seen prior to the economy dipping into recession.

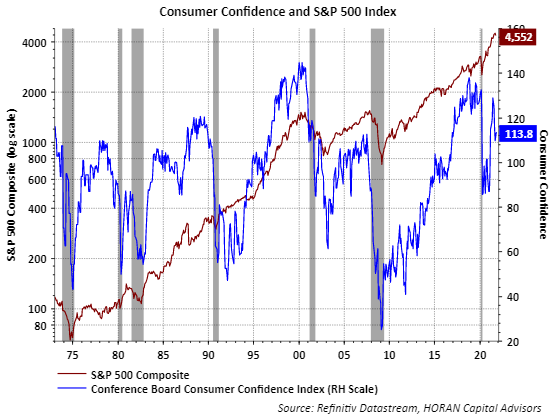

The consumer accounts for 70% of economic activity and TCB's Consumer Confidence reading for October saw a slight increase to 113.8, after falling for the prior three months. But again, is confidence peaking just as the economy is about to slow? If so, it is following a similar pattern to prior economic cycles.

We are not in the camp that a recession is necessarily near given the level of pent up demand. However, we do think there are important structural issues that need to be dealt with, for example, the supply chain issues, unfilled job positions, to name a few. With Congress looking to raise taxes and a Federal Reserve near putting an end to its loose monetary policy, increased market volatility can be a result. Higher taxes from congressional legislation that remove funds from the private sector of the economy and a Fed that may be near raising rates are both potential near term headwinds for asset prices and economic growth.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.