Author: David I. Templeton, CFA, Principal and Portfolio Manager

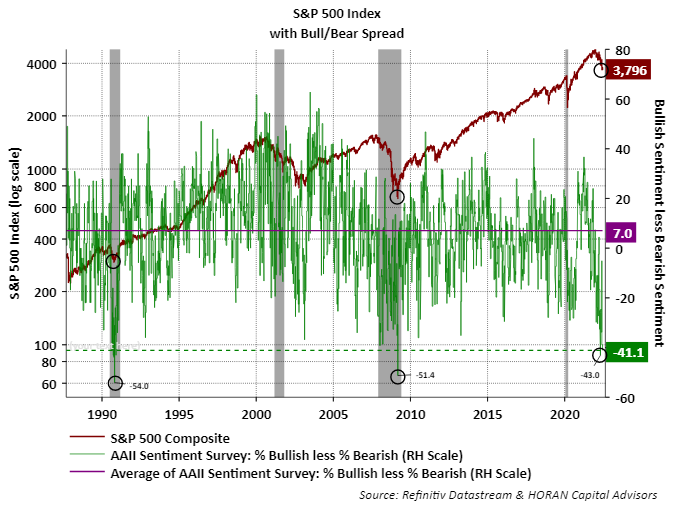

Both individual and institutional investor sentiment is expressing bearishness on future equity returns. The American Association of Individual Investors' sentiment survey reading Thursday shows individual investors remain decidedly bearish on their view of equity market returns over the next six months. The bull/bear spread is reported at -41.1 percentage points and is the seventh lowest weekly spread reading since the survey's inception in 1987. As the below chart shows, historically, this has been associated with equity market turning points.

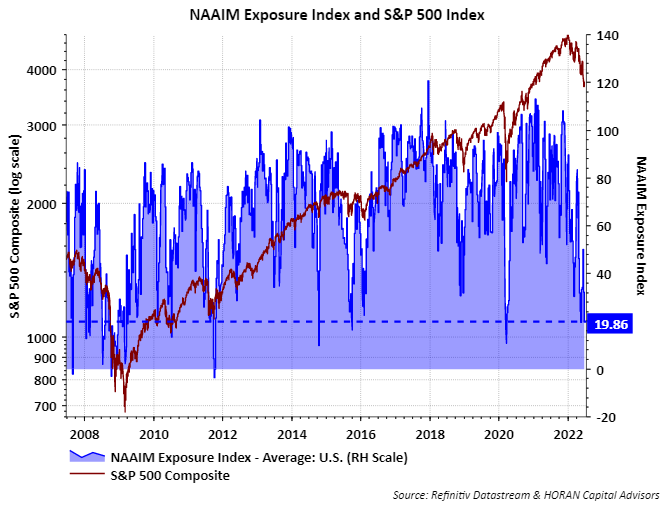

One can gauge institutional sentiment be reviewing the weekly NAAIM Exposure Index. This index consists of a weekly survey of NAAIM member firms who are active money managers and they provide a number which represents their overall equity exposure at the market close on a specific day of the week, currently Wednesday. Responses are tallied and averaged to provide the average long (or short) position of all NAAIM managers as a group. The current NAAIM Exposure Index reading is a low 19.86% as seen in the below chart.

The sentiment measures are contrarian ones, that is, bearish sentiment being expressed by those participating in the surveys would be a bullish sign for equities. On the other hand, the current environment is a unique one given all the cross currents impacting the global economy. Further, if the Fed's higher interest rate policy pushes the economy into a recession, corporate earnings likely get reduced for companies, especially economically sensitive ones. It does seem though that a number of variables are coming together that are indicative of an oversold equity market and I highlighted some of these other variables in an article earlier this week.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.