Author: David I. Templeton, CFA, Principal and Portfolio Manager

With the close of trading for 2024 occurring on Tuesday, it is time to look at the performance of those Dogs of the Dow. The Dogs of the Dow strategy is one that is focused solely on dividend yield. In order to implement the strategy an investor selects the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Average Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. In years where the market generates returns that favor growth-oriented stocks, the Dogs of the Dow strategy has a tendency to lag the Dow Jones Industrial Average Index and the broader S&P 500 Index. In 2024 market returns were certainly focused on growth-oriented stocks and further, the focus was on a handful of megacap stocks.

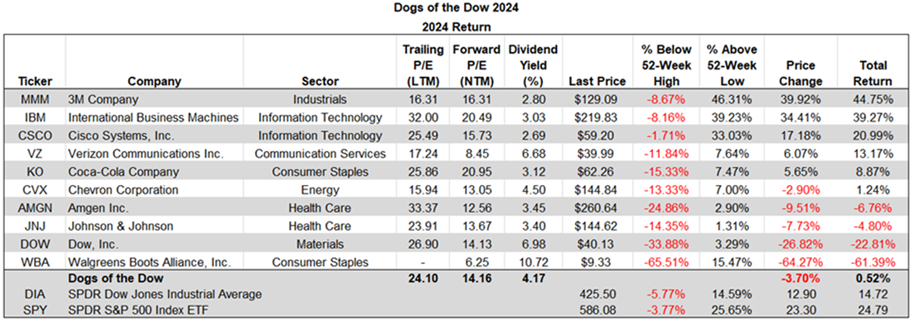

As the below table shows the Dow Dogs performance in 2024 significantly lagged the Dow Jones Industrial average Index, underperforming by more than 14 full percentage points and lagged the S&P 500 Index by more than 24 percentage points.

Sometimes owning the wrong stock can work against returns more than not owning a few of the market winners. In the case of the Dow Dogs of 2024, the holding in Walgreens Boots Alliance (WBA) contributed a negative -12.94 percentage points to the total return of the Dow Dogs' strategy in 2024. WBA lost almost two-thirds of its value in 2024, down -61.4%. Although WBA has a double digit yield it is not eligible for a Dow Dog holding as the stock was removed from the Dow Jones Industrial Average Index in 2024. The second area contributing to the Dow Dogs' weakness was the strategy's Materials position in Dow Inc. (DOW), the second worst performing position, down -22.81%. DOW was removed from the Dow Jones Average Index as well and replaced with Sherwin-Williams Company (SHW).

Investors following this strategy will note there are three changes to the 2025 Dogs of the Dow. The stocks being eliminated:

- 3M (MMM) with a dividend yield of 2.17%,

- Dow Inc. (DOW) is eliminated since the company's stock is no longer a position in the Dow Jones Industrial Average Index and,

- Walgreens Boots Alliance (WBA), again, no longer in the Dow Jones Industrial Average Index.

The three stocks added for 2025 are:

- Merck (MRK) with a dividend yield of 3.26%

- McDonald's (MCD) with a dividend yield of 2.44% and,

- Procter & Gamble (PG) with a dividend yield of 2.40%

As noted in the past, following a dividend only strategy does not always lead to stock outperformance. However, a dividend strategy does have a tendency to hold up better in down markets as was the case in 2022. The Dow Dogs of 2022 generated a return of 2.2% while the Dow Jones Industrial Average ETF (DIA) was down -7.0% and the S&P 500 Index ETF (SPY) was down -18.2%. More thoughts on our views for 2025 will be available in the soon to be completed quarterly Investor Letter.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.