Author: David I. Templeton, CFA, Principal and Portfolio Manager

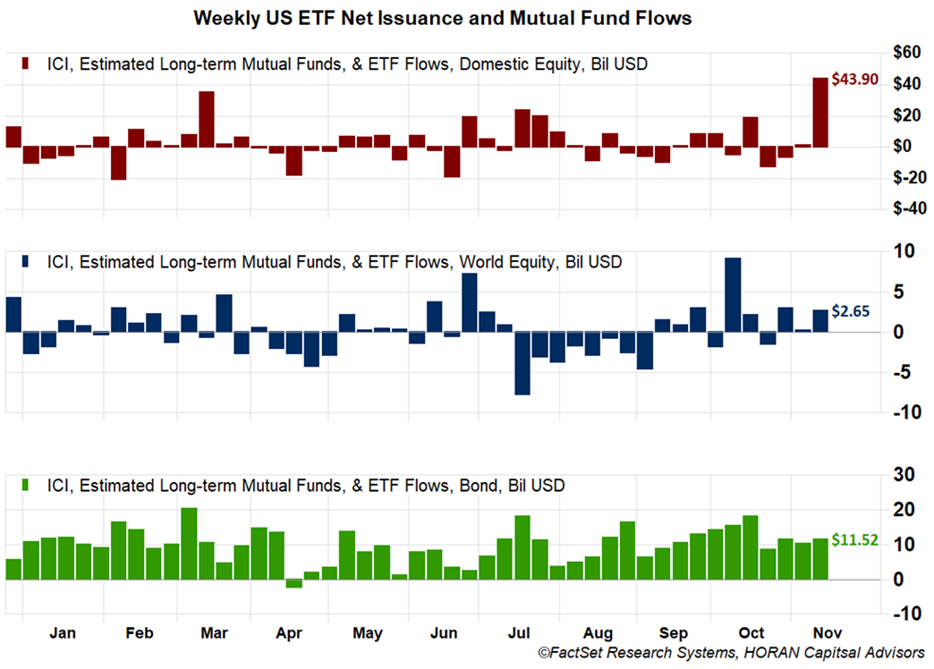

With the election two weeks behind investors, data on fund flows shows the removal of election uncertainty is leading to a pick-up in the level of investment dollars moving into equities. The Investment Company Institute reported flows into domestic equites were up $43.9 billion for the week ending 11/15/2024 as seen in the below chart. Foreign equities and bonds also experienced positive flows.

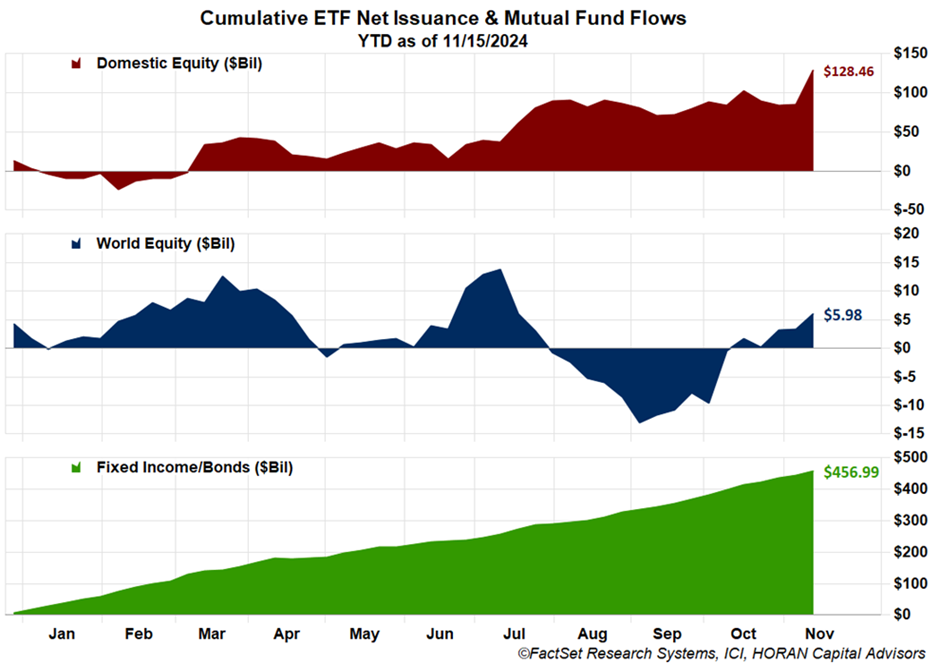

On a cumulative basis both U.S. equities and bonds have experienced strong inflows this year as seen in the first chart below. The second chart below is taken from a post published in mid-December 2023, Equity Funds Experiencing Outflows In Spite Of A Strong Stock Market and the chart shows investors were far less optimistic on stocks in 2023, at least based on U.S. investment flows.

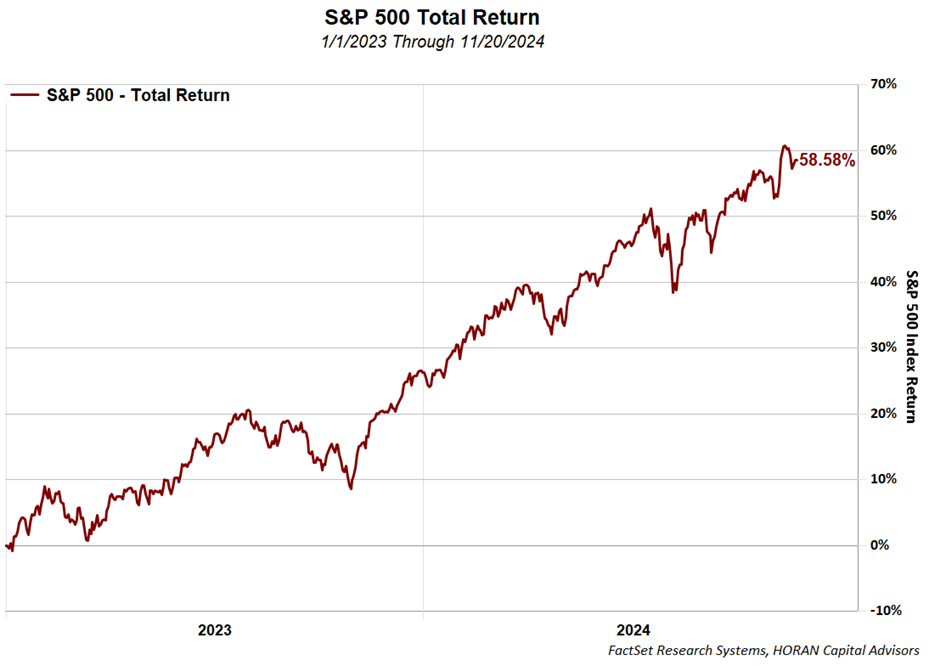

The lack of excitement for stocks in 2023 is somewhat understandable given the near 20% decline in the S&P 500 Index in 2022. As one recalls, nearly every asset category was down in 2022, so investors had very few places to seek shelter from the rough market patch. Conversely, the last two years have rewarded investors generously with the S&P 500 Index up 58% on a total return basis.

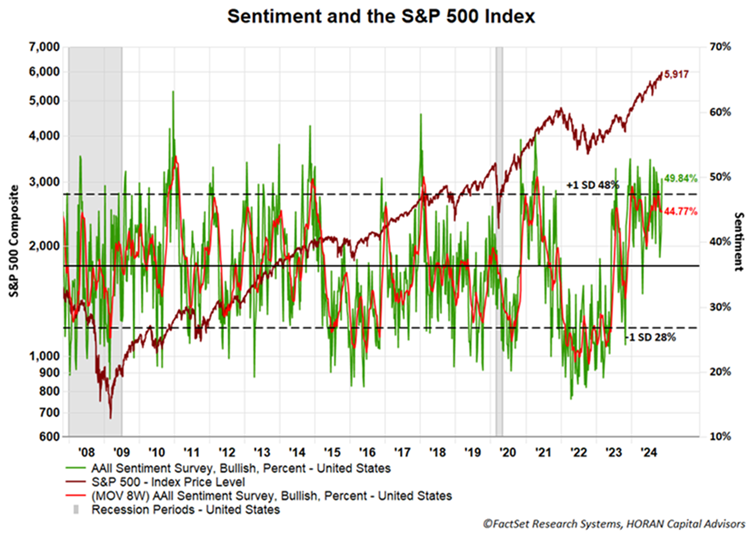

For investors, keep focused on equity categories that have favorable fundamentals on a go forward basis and not simply purchasing stocks because the market has generated strong returns over the past two years. From a sentiment perspective, bullish sentiment as reported by the American Association of Individual Investors is at an elevated level. The individual investor sentiment measures tend to be contrarian measures, i.e., they tend to be the most positive near market tops.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.