Author: David I. Templeton, CFA, Principal and Portfolio Manager

In several earlier blog posts, I have written about the performance differences between growth stocks versus value stocks depending on the business cycle. Below I highlighted a portion of commentary from a paper titled Forecasting Performance Cycles of Value and Growth Stocks in Global Equity Markets, written by David Kovacs, CFA, who was with Turner Investment Partners at the time. Unfortunately, I am unable to find a link to the original paper he wrote. A relevant highlight notes,

"Following periods when short-term rates ease, lending activity and subsequently business development typically accelerate. During these periods value stocks, led by financial and industrial companies, begin to outperform. As the global economy begins to expand, demand for basic materials, such as metals, and energy related commodities, such as oil and natural gas, rises. That leads to an increase in the price of these commodities which in turn has historically led to the outperformance of the stocks of commodity producers and processors."

"As in the case of an economic slowdown, the monetary response to economic expansion is also typically delayed until sustained signs of acceleration in inflation are apparent. In response, central banks begin to hike short-term interest rates to the point where the interest rate yield curve is flat or inverted, i.e. short-term rates are either equal to or higher than long-term rates. Lending activity to businesses then typically slows significantly, profits of financial institutions decline, and financial stock prices begin to lag the market averages. Economic activity moderates, and once again those stocks that can grow their earnings at the fastest pace, namely, growth stocks, typically resume a period of multi-year outperformance."

In short, as the economy begins to accelerate, value companies begin to outperform. Conversely, when the economy begins to slow, those companies that can grow their earnings in spite of the slowing environment (growth stocks) will begin to outperform. Growth stocks have resumed their leadership after underperforming value stocks in 2022

Certainly, the follow-on effects of the pandemic continue to challenge the evaluation of the economic or business cycle data. A technical recession did occur in early 2022 with negative real GDP in the first and second quarter. As economic activity improved in the second half of 2022, that is, positive GDP growth, value stocks did outperform their growth counterparts last year as seen below.

The market continued to favor many of the more value oriented or economically sensitive sectors of the market through the month of January and into the first few days of February this year. As the below bar chart shows, the more defensive sectors, Consumer Staples, Utilities and Health Care, to name a few, were laggards as 2023 got underway.

However, this changed quickly as the calendar rolled into February. The Federal Reserve was showing no inclination it was going to slow the pace of increase in short term interest rates and the debt ceiling debate in Washington rose to the top of the list of concerns, among other factors. As noted at the outset of the article, growth stocks tend to outperform in a slowing economic backdrop as those type of companies tend to be able to grow earnings regardless of the pace of economic growth. Also notable was the fact the defensive sectors of the equity market began to lead performance. The financial sector fell to the bottom of returns as balance sheet issues arose with banks.

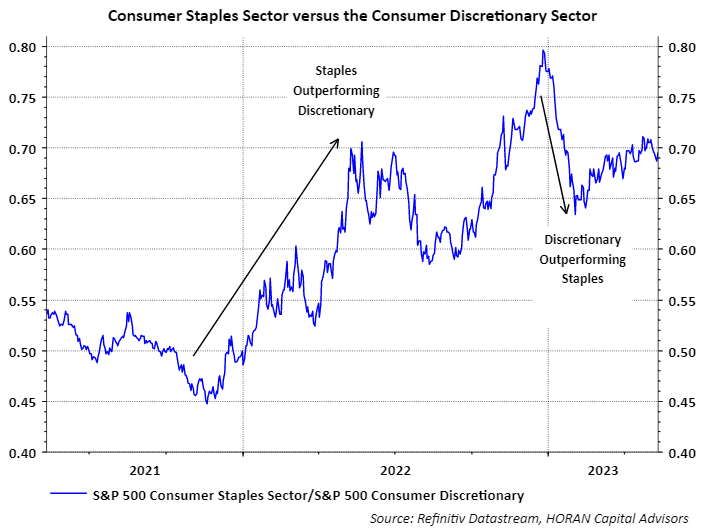

During the first two quarters of 2022, when real economic growth was negative, a technical recession, the more defensive consumer staples stocks outperformed consumer discretionary ones as seen below. This same phenomenon began to occur in early February this year.

One of the difficult aspects in analyzing the current equity market and economy is the amount of conflicting data being released. At HORAN we are not firmly convinced a recession is necessarily going to play out. Though we are seeing pockets of weakness in some segments of the economy, a rolling recession so to speak, like in housing. Some housing data is beginning to improve though. More on this in a later article; however, if only looking at the equity style performance growth's outperformance versus value might be telegraphing an economic slowdown.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.