Author: David I. Templeton, CFA, Principal & Portfolio Manager

As the year began much of the talk was centered around whether the U.S. economy would fall into recession in 2023. The year is only two-thirds done, but a recession does not seem likely this year and our firm has been in the no recession camp since the year began. We have written a couple of times that a technical recession was early 2022 when real GDP was negative in Q1 2022 and Q2 2022, yet not your typical recession.

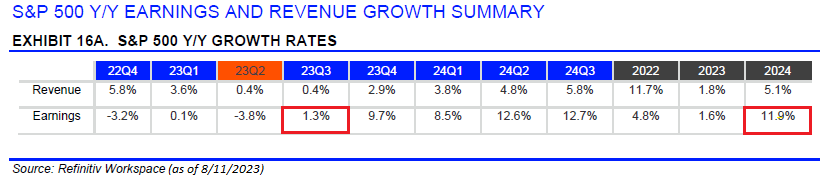

With second quarter earnings reporting season nearly complete, corporate earnings are not looking too bad either. It appears the second quarter earnings for S&P 500 companies will be down approximately -3.8% on a year over year basis. Excluding the energy sector, earnings are expected to be up 2.5%. Ex-energy revenue growth is expected to be up 4.3%. Inflation is serving as a tailwind for both these figures. As the below table from Refinitiv's This Week in Earnings report shows, high single digit year over year quarterly earnings growth is expected to begin in the third quarter of 2023, leading to double digit year over year earnings growth for 2024.

With respect to earnings revisions, they can be volatile; however, the revisions are trending positive in that estimates revised up are exceeding estimates revised lower.

The equity market does not move higher in a smooth line. On a year-to-date basis the total return on the S&P 500 Index at the time of this writing is up a strong 18.1%. It would be healthy for the market to consolidate some of these gains in the near term which might mean an equity market pullback or market consolidation by moving sideways over time. September and October can be volatile months and they are just around the corner. If the market experiences some near term volatility, this could set up a rally into year-end which might lead to more recession chatter for 2024.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.