Author: David Templeton, CFA, Principal and Portfolio Manager

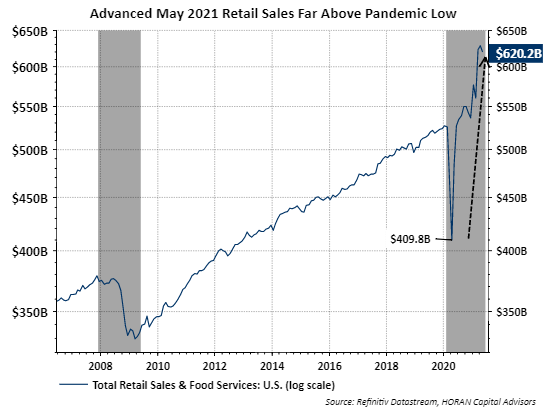

Many states have reopened their economies and consumers have responded by increasing spending in an effort to satisfy pent-up demand. The sharp recovery in overall retail sales may have surprised some; however, with consumers accounting for 70% of economic activity, this activity is supercharging economic growth. As the below chart shows, May retail sales equals $620.2 billion and is sharply above the pandemic low of $409.8 billion.

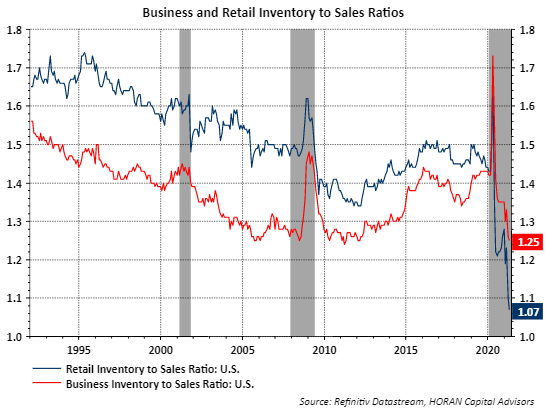

The strong consumer demand has overwhelmed retail and business inventory levels and this shows in the low inventory to sales ratio of these segments.

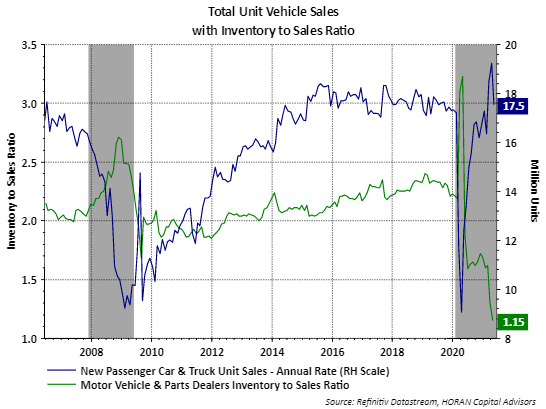

Much has been written about shortages of semi-conductor chips resulting in auto manufacturers not able to complete the build out of cars and trucks. A consequence of the shortage of new cars is the price of both new and used autos has increased. Some of this price inflation has been met with resistance by consumers and they are pushing back on the price increases. As is often said, high prices will fix high prices. The automobile situation is evident in the below chart with the inventory to sales ratio at a record low level of 1.15 to 1.0. The low inventory level and higher prices have both contributed to a down tick in new vehicle sales to an annual rate of 17.5 million units versus April's annual rate of 19.2 million units.

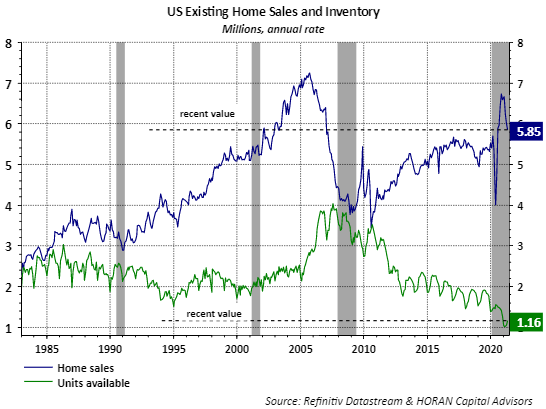

And lastly, another area experiencing a supply and demand imbalance is in the housing market. However, just like higher prices in the auto market, maybe the higher prices in the housing market are creating some consumer resistance to paying a higher home price. Late last year existing home sales were running at an annual rate of 6.7 million units. The April existing home sales rate has declined to 5.8 million units.

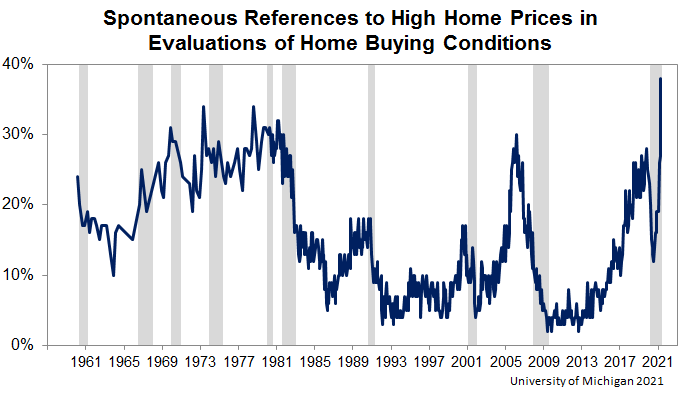

Clearly, units available for sale are near record lows, but up from February's low and likely due to some consumer resistance to higher prices. This can be seen in some of the consumer sentiment surveys. The recent University of Michigan Consumer Sentiment Survey shows a record 38% of respondents noted home prices are high.

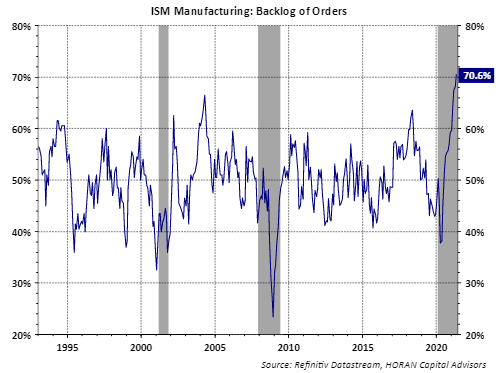

As outlined above it does appear higher prices are resulting in some resistance by consumers which should potentially lead to some inventory build up. Additionally, as more individuals move back into the work force, manufacturing companies will be able to increase production levels and work off some of the record backlog of orders. In the end though, these variables are reflective of a very strong economy.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.