Author: David I. Templeton, CFA, Principal and Portfolio Manager

The Ukraine/Russia development over the weekend is not a new event for these two countries. Russia invaded and annexed Crimea back in February 2014 and began what has become a multi-year effort to control Ukraine. In that year the S&P 500 Index generated a total return of 13.69%. Historically, these crisis events tend to have a short term impact on the equity market and present more of a buying opportunity for investors. As S&P notes in a report referenced below, "sell the scare, buy the bombs."

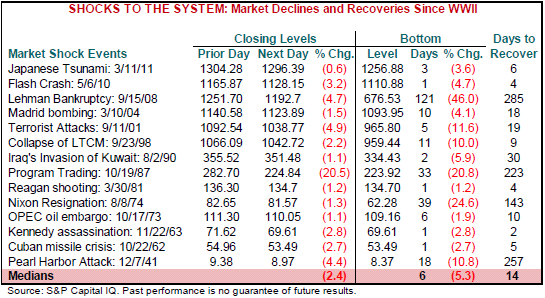

I have written about crisis events in the past and referred readers to a research paper prepared by S&P Dow Jones Indices titled Shocks & Stocks. The paper includes a discussion about the performance of the equity market around these crisis periods and includes the below table.

As can be seen in the above table, of the fourteen shock events listed, the average market decline was 5.3% and losses were recovered in an average of 14 days. Certainly, several of the loss periods were much greater than the average and the recovery time period much larger than the average. S&P notes though,

"Granted, even though selected events took much longer to play out than the medians would suggest, these extreme situations usually occurred within the confines of a long-term bear market and did not precipitate the initial decline. Examples of these include: 1) Pearl Harbor, 2) President Nixon’s resignation, 3) the terrorist attacks on 9/11, and 4) the collapse of Lehman Brothers. So should history repeat itself, and there is no guarantee it will, unanticipated events that occur within bull markets that throw markets for a loop are typically assessed for their economic impact in short order, allowing opportunistic traders to step in and quickly push share prices back to break-even and beyond."

The one potentially problematic issue facing the market is the price of oil. The price of oil is approaching $100 per barrel and the Ukraine/Russia situation may push oil prices higher in the near term. Oil/energy impacts a large part of the economy. Historically, high prices, if they stay high, can have a negative impact on the economy due to the impact on prices broadly and the headwind it creates for consumers. However, in the 2014 Russia incursion into Ukraine, oil prices at that time were above $100 per barrel.

If the futures market Monday night is any indication, the equity market will be volatile and down Tuesday morning. Once investors evaluate the overall impact of this crisis on global markets though, market instability may be short lived.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.