Author: David I. Templeton, CFA, Principal and Portfolio Manager

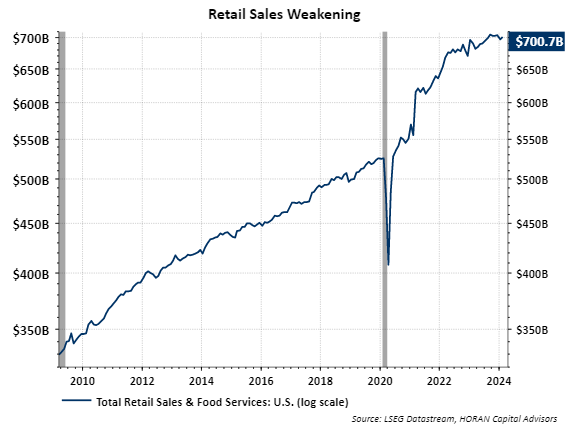

The consumer, or personal consumption, accounts for nearly 70% of U.S. GDP and for that reason it is important to evaluate the overall health of the consumer. Since September of last year the overall level of retail sales has stalled, although a slight uptick was seen in last week's retail sales report, but the reported sales figure missed estimates.

Some of the weakness may be attributable to consumers mostly satisfying deferred spending resulting from the pandemic and housing market weakness as a result of higher mortgage interest rates. Areas seeing sales weakness compared to the end of last year include building materials, furniture and home furnishing stores and gasoline station sales.

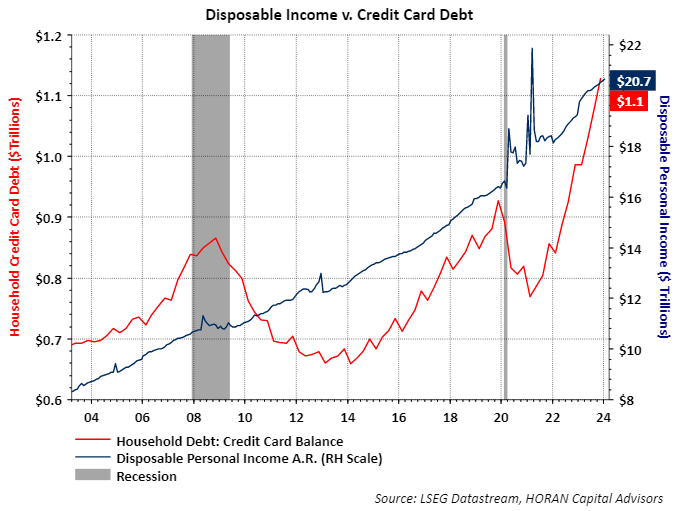

One consumer area worth keeping an eye on is their exposure to credit card debt. Credit card balances have increased significantly since the pandemic ended as seen with the red line in the below chart. The chart also includes the level of disposable income and this has increased but at a slower pace than the growth in credit card balances.

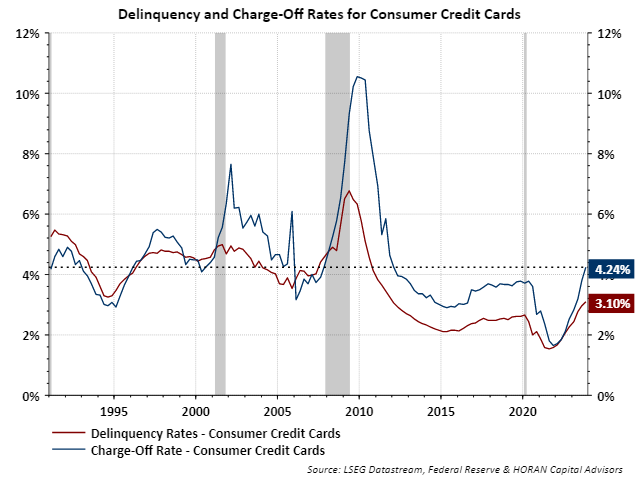

The higher level of credit card debt appears to be leading to repayment issues. Charge offs and delinquency in credit card debt is increasing and is reaching levels seen at the start of prior recessions.

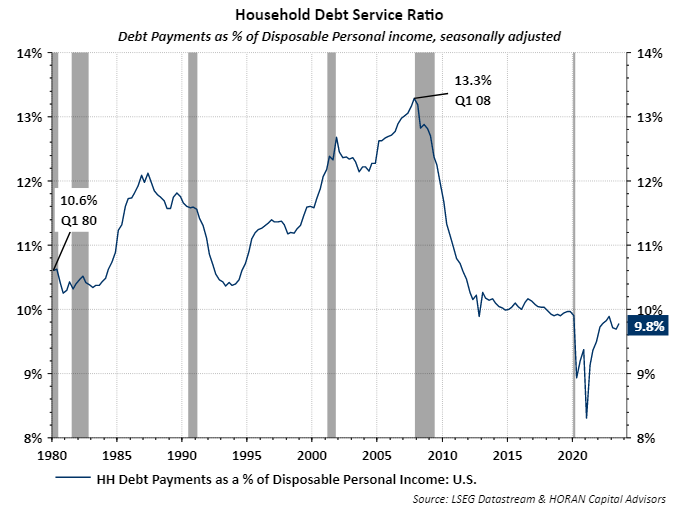

As has been the case with much of the economic data following the pandemic, the credit card data seems at odds with consumer income levels. The elevated credit card delinquency and charge off rate is occurring at a time when households' debt service remains low. The below chart shows debt payments as a percentage of disposable personal income are near record lows at 9.8%.

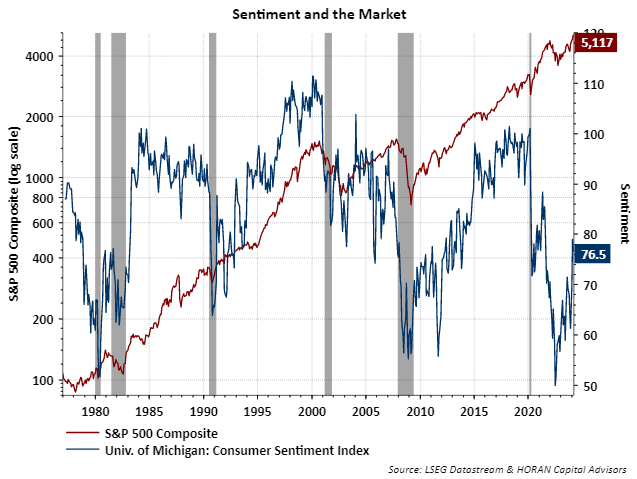

And lastly, the Michigan Consumer Sentiment Index is far above its low in June 2022. So, in spite of what appears to be weakness in revolving credit debt, consumers are indicating they have improved confidence in the economy.

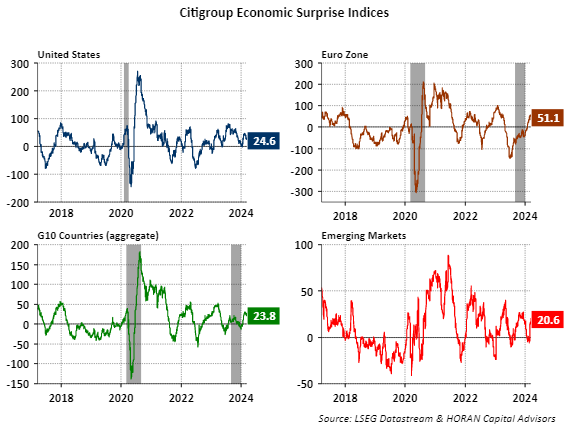

With the consumer representing a significant percentage of the economy or GDP, the elevated charge off rate and delinquency in credit card debt might be a canary in the coal mine suggesting some economic headwinds ahead. For the moment though overall economic data is coming in better than expected, not only in the U.S. but globally too. Maintaining a focus on the health of the consumer will be important as the year progresses.

HORAN Wealth, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HORAN Wealth and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Wealth, LLC, please see our Client Relationship Summary at adviserinfo.sec.gov/firm/summary/333974.